Do you understand the import tariffs for coffee

Do you understand the import tariffs on coffee

Coffee is a product from the equator to the fifteenth degree north latitude, so it is produced in regions such as Indonesia, Africa, and South America. Coffee beans produced in Indonesia and some African countries can enjoy preferential tariffs if they meet the conditions.

Indonesian Coffee

First of all, let's talk about the coffee beans in Indonesia. The most representative ones are the Sumatran Manning coffee beans, cat manure coffee beans, and Java coffee beans. Indonesia is a member country of the Association of Southeast Asian Nations (ASEAN). If importing enterprises purchase coffee beans in this country, obtain ASEAN preferential certificate of origin and prepare customs clearance documents, they can enjoy the ASEAN tariff rate when importing.

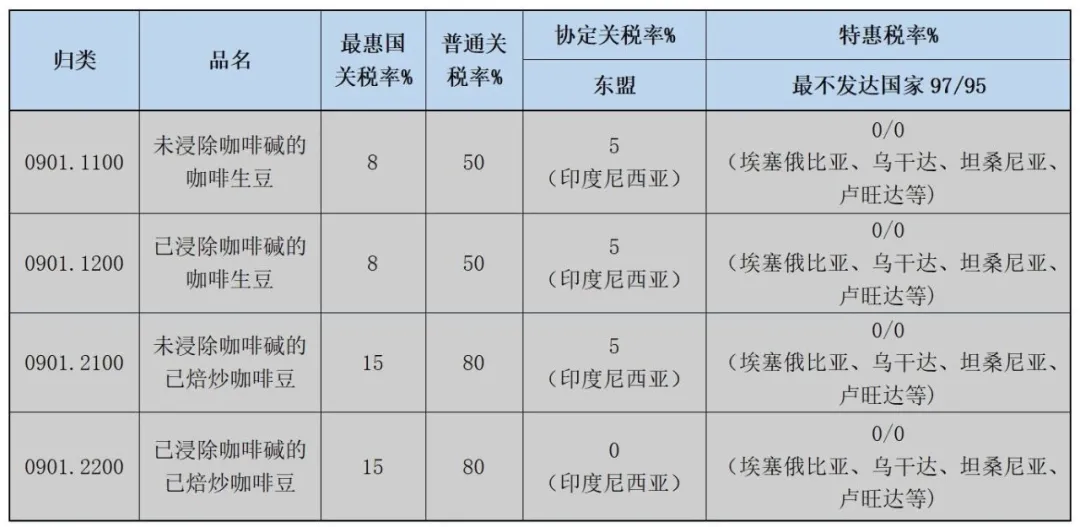

Coffee beans are divided into unbaked beans and roasted beans, with different product codes and corresponding preferential tax rates. Unbaked beans are what we commonly refer to as raw beans. If they have not been soaked in caffeine and are classified under the product code 0901.1100, they can enjoy a 5% ASEAN treaty tax rate; If the caffeine has been soaked, it will be classified under the product code 0901.1200 and will also enjoy a 5% ASEAN treaty tax rate. If roasted coffee beans have not been soaked in caffeine and are classified as commodity code 0901.2100, they can enjoy a 5% ASEAN treaty tax rate; If the caffeine has been soaked, it will be classified as commodity code 0901.2200 and can enjoy zero tariff under the agreement.

Therefore, import enterprises must first understand the processing technology of coffee beans, accurately classify them, and apply for a valid preferential certificate of origin before applying for the applicable treaty preferential tax rate.

African Coffee

Africa is the birthplace of coffee, and coffee has also become a major economic crop in many African countries. Among numerous production areas, Ethiopia, Kenya, Tanzania, Uganda, C ô te d'Ivoire, and others are quite famous. Among them, Ethiopia is known as the "hometown of coffee", and its "mocha" is particularly outstanding.

Our country has provided special preferential tariff treatment to the least developed countries that have established diplomatic relations with our country, and Ethiopia is one of them. If importing enterprises purchase coffee beans in Ethiopia, obtain the least developed country preferential certificate of origin and prepare customs clearance documents, regardless of whether the coffee beans are imported without baking or have been baked, they can enjoy the preferential tax rate of 0. Coffee imported from countries such as Uganda, Tanzania, and Rwanda can also enjoy preferential tariff treatment.

This table can provide a more intuitive understanding of the differences between coffee most favored nation tariffs, regular tariffs, and preferential tariffs.

When enterprises import goods, they can pay more attention to the origin of the goods, learn more about preferential policies for origin, and handle relevant procedures in advance. This way, they can legally and legally enjoy preferential tax rates and save costs when importing.

本文来源:http://www.jtia56.cn/list_68/370.html

本文标题:Do you understand the import tariffs for coffee

注:本文部分图文来源于网络,如有侵权联系我们删除,谢谢!

【 Customs Knowledge 】 Key Points for Importing Flaxseed 【 Customs Knowledge 】 Take you to understand the key poin

迦泰通(海关AEO高级认证企业)-服务范围

迦泰通19年进出口通关经验,10+分公司,支持全国进口申报;是海关AEO高级认证企业,专注全球门到门,一站式进口代理清关服务!我司业务范围:国际运输、进口报关清关、仓储配送、代签外贸合同与付汇、暂时进出口等。全国免费咨询电话tel:18521306667

【相关推荐】

- 了解详情 > How much do you know about sports nutrition food?

- 了解详情 > Customs knowledge: Chinese medicinal materials that are haza

- 了解详情 > Customs Knowledge: New Regulations on the Import of Special

- 了解详情 > [Customs Knowledge] How much do you know about infant formul

- 了解详情 > 【 Customs Knowledge 】 Import of baking raw materials such

- 了解详情 > 【 Customs Knowledge 】 Inspection and Quarantine Requireme