【 Customs Knowledge 】 Classification of Base Metal Produc

source:http://www.jtia56.cn time:2023-10-10 21:17:22

Classification of imports of base metal products

Base metals generally refer to other metals besides precious metals such as gold, silver, and platinum. Due to its active chemical properties, it is widely used in the metallurgical industry. From blades used in aerospace industry machine tools, welding rods used in automotive manufacturing, to various cutting tools used in home kitchens... they are widely used and can be seen everywhere.

Due to the wide variety, the corresponding tax code columns and standardized declaration requirements for this type of goods in the import and export process are different.

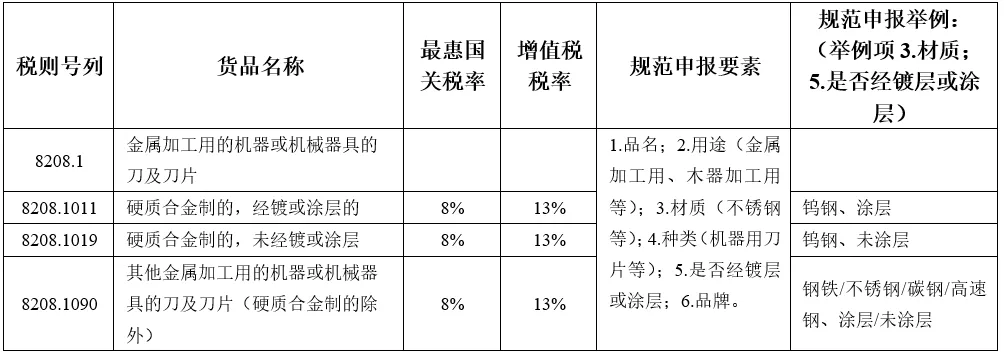

1、 Knives and blades for machines or mechanical tools used in metal processing

Error examples and explanations

Product name declaration: "Broach blade"

Declaration in the specification and model column: "Purpose: for metal processing | Material: high-speed steel | Type: machine broach | Whether coated or not: uncoated | Brand: xxx"

Declaration classification: classified as hard alloy steel with tax number 8208.1011 or 8208.1019

Case Description: Classification error, should be classified under tax number 8208.1090. The declared material is high-speed steel, which does not belong to the hard alloy system and should not be classified as the hard alloy steel tax number 8208.1011 or 8208.1019.

Tips

Hard alloy is a type of alloy material formed by sintering metal carbides with metals. It is mainly composed of micron sized powders such as tungsten carbide, a high hardness refractory metal, and cobalt, nickel, or molybdenum as binders. It is sintered in a vacuum furnace or hydrogen reduction furnace to form powder metallurgical products. According to material classification, common types include tungsten cobalt hard alloy (YG), tungsten titanium cobalt hard alloy (YT), tungsten tantalum cobalt hard alloy (YA) Tungsten titanium tantalum cobalt hard alloy (YW). Hard alloy cutting tools used for metal processing, machines or mechanical appliances are classified under six digit tax number 8208.10, those with coatings or plating are classified under tax number 8208.1011, and others are classified under tax number 8208.1019.

Truly declare according to the material, with a focus on whether it is a hard alloy product made by sintering metal carbides with metal. If the declared material is steel, stainless steel, carbon steel, high-speed steel, etc., it does not belong to the category of hard alloy and should be classified under tax number 8208.1090.

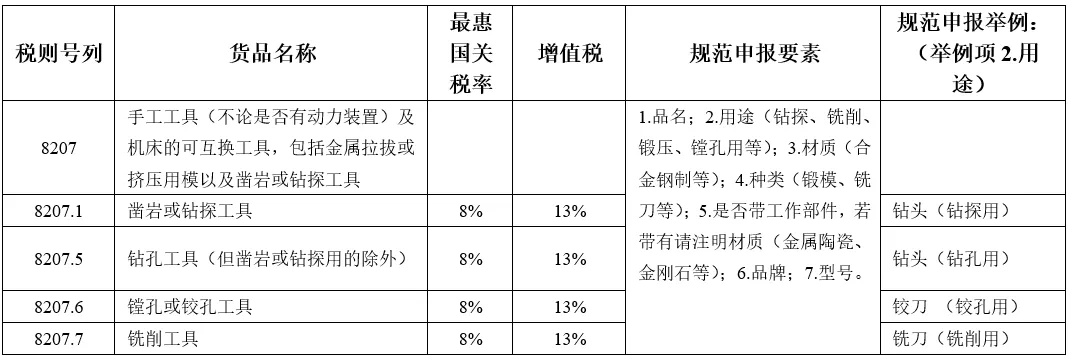

2、 Interchangeable tools for hand tools and machine tools

Error examples and explanations

Product name declaration: "Drill bit"

Declaration in the specification and model column: "Purpose: Drilling | Material: Tungsten alloy | Type: Drill bit | With or without working parts: Without working parts | Brand: xxx | Model: xxx"

Declaration classification: classified under tax number 8207.5090

Case Description: Classification error, should be classified as 8207.1. The purpose declaration is "for drilling" and is not a drilling tool and cannot be classified as 8207.5.

Tips

Item 8207 includes interchangeable tools for hand tools and machine tools, which must be used in conjunction with specific goods. Specific product codes are assigned based on their purpose and whether they come with working parts. Among them, rock drilling or drilling tools, including mining, oil well drilling or exploration tools; Drilling tools, except for rock drilling tools. Please classify the goods under the corresponding tax number based on their declared purpose and the condition of the working parts.

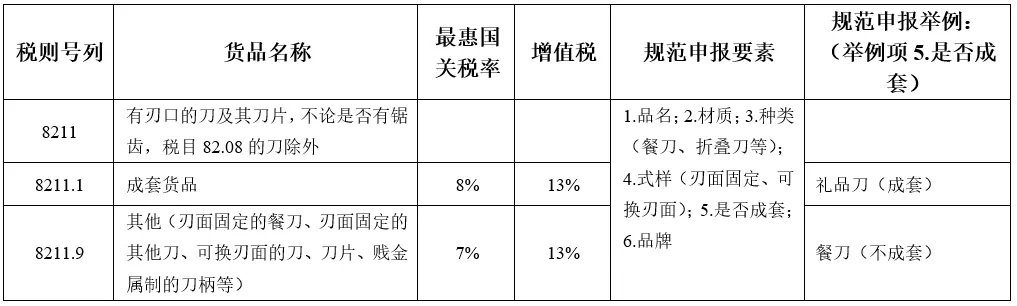

3、 Knives with cutting edges and their blades

Error examples and explanations

Product Name Declaration: "Gift Knife"

Declaration in the specification and model column: "Material: stainless steel | Type: folding knife | Style: fixed blade surface | Whether complete set: complete set | Brand: xxx"

Declaration classification: classified under tax number 8211.9300.

Case Description: Classification error, should be classified under tax number 8211.1000. The declared specifications indicate a complete set of cutting tools, which should be classified as a complete set of goods according to the tax regulations.

Tips

According to the annotation of subheading 8211.10, "complete sets" are only limited to sets of goods composed of different types of cutting tools or sets of goods composed mainly of cutting tools in quantity. Before conducting standardized declaration, it is necessary to understand the actual situation of the goods and pay attention to whether they are "complete sets".

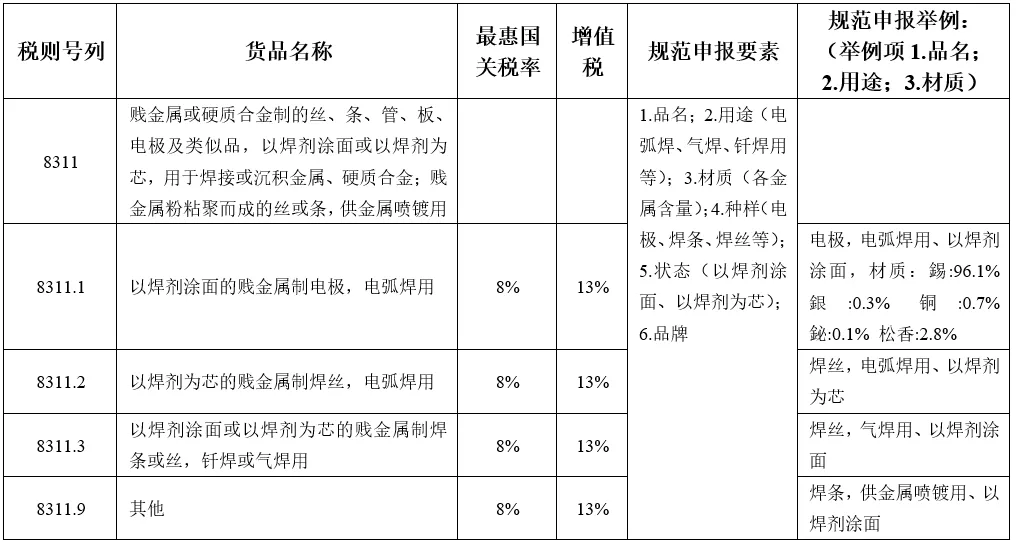

4、 Electrodes, welding rods, welding wires, etc. made of base metal or hard alloy

Error examples and explanations

Product name declaration: "Electrode"

Declaration in the specification and model column: "Purpose: arc welding | Material: base metal | Type: electrode | Status: coated with flux | Brand: no brand"

Declaration classification: classified under tax number 8311.3000.

Case Description: Classification error, should be classified under tax number 8311.1000. Declaration of "arc welding" and "coating with welding flux", not for brazing or gas welding, should not be classified under tax number 8311.3000, but should be listed and classified according to tax regulations.

Tips

Heading 8311 includes wires, rods, tubes, plates, electrodes, and similar products made of base metals or hard alloys used for welding or deposition of metals or hard alloys. These products are classified into specific subheadings based on their use (arc welding or brazing gas welding) and state (flux coated or flux cored).

If the welding wire and electrode material is composed of any alloy with a precious metal content of 2% or more by weight, it cannot be classified as heading 8311 and should be classified as precious metal in Chapter 71.

2. Item 8311 requires distinguishing product codes based on their purpose and status. Welding wires (rods) used for arc welding are classified under tax number 8311.10 or 8311.20 based on whether the surface is coated with flux or the core is flux. Welding wires (rods) used for brazing or gas welding are classified under tax number 8311.30 regardless of whether the surface is coated with flux or the core is flux; Other base metal adhesive wires or strips used for metal spraying, as well as similar products other than the aforementioned welding wires (strips), are classified under tax number 8311.90.

Thank you for reading. If you have any import related questions, please feel free to contact our company.

24-hour global service hotline: 18521306667

Group distribution: Shanghai/Ningbo/Jiangsu Tianjin/Beijing/Dalian/Qingdao Shenzhen/Guangzhou/Xiamen/Hong Kong Wuhan/Chengdu